Visante’s Top 10 Pharmacy Issues in 2024

Steve Rough, Phil Brummond and Jim Jorgenson

Pharmacy is a difference-maker for health system financial and operational performance.

Download the executive summary here.

In 2024, pharmacy will play an even more significant and critical role in health systems’ financial and operational performance nationwide. While health systems face daunting challenges, increasing risks, and suffocating regulatory and compliance burdens, high-performing pharmacy organizations are poised to mitigate financial losses and improve operations. We’ve never been more bullish about the opportunities for engaged pharmacy executives and leaders in the years ahead.

Skyrocketing drug costs, 340B challenges, growing demands on a shrinking workforce, and the leakage of infusion services and associated financial losses are a few of the challenges we discuss here. But with challenges come opportunities, and in this edition of Visante’s Top 10, we’re pleased to offer exciting and timely solutions that health systems can take advantage of in 2024 and beyond.

1. Winning in the Face of Pharmacy Workforce Challenges

Tara Bracken and David Hager

As a pharmacy profession, we often say “yes” to new roles and responsibilities to serve our patients and elevate our standing in the organization. While this is a commendable effort, the result is an unfortunate and troubling imbalance between resources and workload. Add in the continued workforce shortages for nurses, physicians, technical staff and others, and we see roles continuing to blur as the patient care needs remain constant. This is why the healthcare workforce remains a top concern of healthcare C-suites across the country.

Reframing Practice Advancement

In 2023, pharmacy workforce efforts focused on essentials: prioritizing workforce mental health and well-being, enhancing compensation, and expanding flexibility through work-from-home or hybrid models. In 2024, pharmacy workforce efforts will need to include new approaches to employee career paths (such as latticed career ladders), refine core services in inpatient practice, and identify new opportunities for service line expansion.

Winning in Inpatient Settings

The nursing shortage provides a unique opportunity for pharmacy to expand its interdisciplinary role. Technicians are the backbone of any successful pharmacy department. Combining new roles with a formalized career lattice and compensation growth is key to addressing technician shortage concerns and becoming an employer of choice for both pharmacists and pharmacy technicians. Determining the necessary resources to fill gaps requires a comprehensive assessment of the pharmacy infrastructure, including:

- Organizational expectations: What core services does pharmacy add value to within the team? What is the focus right now, operational efficiency or operational excellence?

- Pharmacy resources: Are there enough resources to support the current and anticipated workload based on the functions pharmacy fulfills within the organization? Where can technicians take new roles from pharmacists to advance technician and pharmacist practice?

- Staff competency: How equipped are staff to flex into new roles to mitigate turnover gaps?

- Practice advancement: What inherited tasks no longer add enough value to continue? What would a new model of care look like that matched current – not past – organizational needs?

- Through reevaluation, leaders can identify core pharmacist activities, outdated tasks, and roles that can be performed equally by a lower-level skill mix. This can bring supply and demand back into balance and drive top-of-license practice, even with the opportunities presented in the outpatient setting.

Winning in Outpatient Settings

Nationwide, retail pharmacy walkouts spotlight pharmacy workforce concerns and catch the public’s attention. Some retail chains have filed for bankruptcy. Others have been forced to reduce hours. As advocacy for safe working conditions unfolds in the face of challenging economic realities, patient safety and medication adherence hang in the balance.

Health system pharmacies have a unique opportunity to expand their ambulatory pharmacy footprint to meet community needs. Access to the medical record better equips pharmacists to practice at the highest level, positively impacting population health through transitions of care and chronic disease management services. Health system pharmacy leaders must move away from corporate dispensing metrics to focus on patient-specific outcomes while integrating health system and community/retail pharmacy practice. A model focused on patient-centered services and real-time interprofessional decision-making can drive the innovation needed within the community/retail pharmacy sector while generating new revenue opportunities.

Key Takeaways

To optimize and adapt to meet the needs of patients in 2024, workforce and practice development should include:

- Reassess the pharmacy scope of services, infrastructure, practice models, and workflows to reduce turnover and create a more sustainable workplace that appeals to the new generation of clinical pharmacists.

- Technician career advancement, with a focus on specialization and increased clinical responsibilities, to prevent future shortages and supplement pharmacist capacity.

- Broaden health-system ambulatory and in-home pharmacy presence to create a sustainable model that utilizes medical record integration to drive collaboration and enhance patient outcomes.

2. Mitigate Contract Pharmacy Restrictions with an Internal Specialty Pharmacy Program

Herolind Jusufi, Angie Amado and Joe Cesarz

The number of manufacturer 340B contract pharmacy exclusions is increasing. As a result, health systems have a renewed focus on the value of an internal specialty pharmacy program. To mitigate 340B contract pharmacy losses, organizations should work to understand leakage and develop solutions to recapture these prescriptions. Here are four steps you can take to get started:

-

Review the manufacturer landscape and current restriction categories.

Conduct a comprehensive review of your third-party administrator(s) (TPA) to identify top drugs by volume and savings opportunity. This review will help prioritize internal program efforts based on where current and anticipated future losses are occurring. You can also analyze prescribing and pharmacy dispensing data to reveal current capture rates across key products and clinics to help set targets for what can be internalized based on payer and drug access.

-

Evaluate your operational capabilities for referrals and prescription fulfillment.

Assess your capacity to provide internal medication access services and your ability to secure referrals for products requiring prior authorization and financial assistance. Technology may also help to capture prescription refills or medications that do not require prior authorization. Pharmacy leaders should also consider proactive drug shortage management, improved logistics capabilities, and downstream staff and space needs. Further efforts may be needed to centralize and streamline your medication access processes to make them seamless for providers and patients.

-

Reduce administrative burdens on providers and promote the value of specialty pharmacy to patients.

Develop collaborative practice agreements for refill management or product interchange and consider targeted efforts to improve patient outcomes. These services promote holistic patient care and increase collaboration with clinic providers, reinforcing the value of your specialty and retail pharmacy programs.

-

Don’t limit your specialty pharmacy program to traditional high-cost drugs.

Many non-specialty products are on the market where patients would benefit from the higher-touch services offered by specialty pharmacy. These medications can significantly mitigate contract pharmacy losses and support the patient’s total care.

3. How to Recognize the Value of Pharmacy-based Ambulatory Infusion Sites

Erick Siegenthaler and Jeff Prosch

In 2024, we expect pharmacy-based ambulatory infusion suites (AIS) to become a crucial way for health systems to successfully address the growing need for infusion capacity and site of care (SOC) challenges while supporting nursing efficiency. Let’s explore the pharmacy-based AIS world and the essential coordination strategy across multiple SOCs that organizations should focus on in the coming year.

Definition and Nomenclature Challenges

Infusion services occur in various alternate SOC settings, including physician offices, freestanding infusion clinics or home infusion. Pharmacy-based AIS, a newer development, stems from the expansion of home infusion services and expands the offerings of home infusion providers. The National Home Infusion Association (NHIA) defines pharmacy-based AIS as a setting where clinical care is provided under a physician’s orders, with the pharmacy as the billing provider. In other words, the pharmacy-based AIS serves as a hybrid between home infusion billing and an infusion-clinic “lite” setting.

Competition from Outside Firms

Increased competition from for-profit entities entering the alternate site infusion field poses another challenge to health systems. It’s necessary to understand strategic investments by private equity firms to reveal the evolving nature of pharmacy infusion services and an identified area of opportunity for these businesses. A strong organizational infusion strategy is vital to prevent unnecessary loss of services to outside competitors.

Integral Role in the Continuum of Care

Pharmacy-based ambulatory infusion suites are pivotal in health systems’ pharmacy continuum of care. Health systems can seamlessly address challenges due to the shift from hospital-based centers to outpatient settings while offering more efficient nursing workflows. Additionally, organizations will need multiple service levels to provide care as new medications come to market with various administration methodologies and payer benefit management practices.

Central Prior Authorization Opportunities

As payers increasingly focus on high-cost drug products, managing and coordinating SOC becomes an important theme for organizations. It will be critical for organizations to prioritize centralized prior authorization of all medication services through pharmacy to help navigate appropriate options. This will create efficiencies, remove administrative burdens from clinic staff, and help reduce infusion service leakage to competitors. Central prior authorization is the “easy button” for your care providers!

Cost-Effective Buildout and Examples

At Visante, we work with a wide variety of organizations to support alternate site infusion services. Organizations are often surprised to learn that these suites are relatively low-cost to build. Identifying unutilized space within organizations allows for cost-effective development and repurposing. We especially see opportunities following the COVID-19 pandemic, including administrative spaces vacated due to remote work or spaces leveraged for COVID-19 therapies but no longer used. Listen to our podcast The Infusion Market is Evolving – Are You Ready? to learn how the University of Maryland established an infusion suite.

Empowering Health System Leaders: A Coordinated Approach

Implementing home infusion and AIS services is a valuable move for decision-makers. Clear articulation of SOC challenges to stakeholders, collaboration with senior leadership, and engagement with prior authorization teams are imperative. A coordinated approach across multiple SOCs, including hospitals, offices, pharmacy-based infusion suites, home infusion, and specialty pharmacy, ensures seamless patient transitions and optimized resource utilization.

In conclusion, the rise of multiple infusion SOCs continues to be a transformative phase in managing patient pharmacy services within health systems. For health system leaders exploring healthcare innovations, it will be critical to embrace pharmacy-based infusion services and adopt a system infusion strategy to drive future success.

4. Three Common Pharmacy Revenue Cycle Challenges – and How to Tackle Them

Maxie Friemel and Heather Schrant

It’s clear that pharmacy is no longer just a cost center but a key revenue driver for health systems. That’s why it is more important than ever to understand how your pharmacy revenue cycle is functioning and what you can do to optimize it.

The average denial rate for a medical claim is 5-10%*. Medical billing, especially for high-cost medication infusions, is a highly specialized function many healthcare professionals don’t fully understand. And medical benefits can overlap with many other service lines, including specialty pharmacy, infusion services, and the supply chain, including 340B. But when you evaluate and optimize the pharmacy revenue cycle, all those complex components should pull together to drive maximal value for the organization.

Here are the three biggest pharmacy revenue cycle challenges our clients face today, and how we’re helping them address those issues.

-

Pharmacy basics are becoming more complex – and harder to manage.

Basic pharmacy tasks, like tracking new drugs from formulary and applying the correct electronic medical record (EMR) build and coding, have become more difficult to handle. In particular, we’re beginning to see a sharp increase in brand-specific Healthcare Common Procedure Coding System (HCPCS) codes. As a result, what was once a basic and easy function is now becoming more challenging for health systems.

The consequences of poor coding maintenance can be steep. Just one coding error on a single drug can leave organizations with millions of dollars on the table. To mitigate the revenue leakage associated with coding errors, it’s critical to have the right monitoring system in place so that you can quickly identify and correct errors. Regular audits that capture all angles of the process are also essential.

Health systems’ ability to maintain the mid-cycle will be more critical than ever in 2024. And as basic coding tasks continue to become more complex, pharmacy operations and revenue cycle teams will need to collaborate closely to ensure the process is clean and optimized.

-

If you don’t understand your managed care contracts, you’re likely leaving dollars on the table.

Managed care contracting is another area that is emerging as a key opportunity to enhance the pharmacy revenue cycle. Health systems need to understand how drugs are getting paid for – not only in terms of medical benefits but specialty benefit carve-outs as well.

You can often uncover areas of waste simply by better understanding the mechanics of these contracts. For example, your contract requirements could be driving site of care (SOC) issues that require specialty infusion services to be referred outside the organization. Or conversely, you might be spending lots of time managing SOC issues that aren’t making any difference in your contracts.

Pharmacy and managed care contracting are interconnected. That’s why it’s important to have clear communication with these two teams to ensure alignment between your contracts and your pharmacy operations.

-

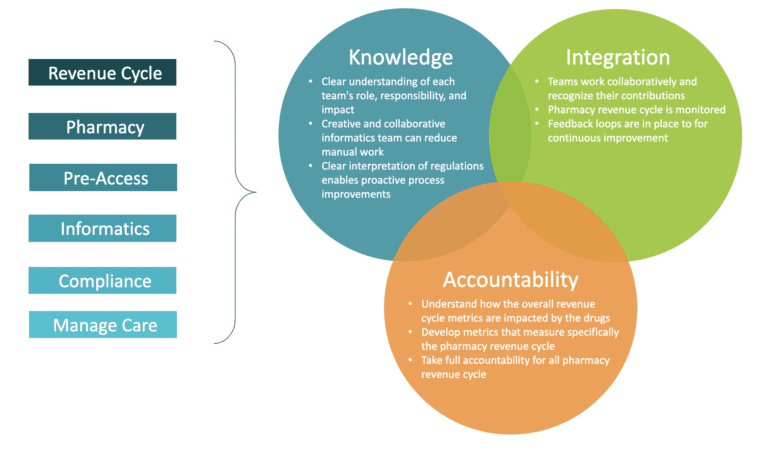

Creating an integrated pharmacy revenue team can be challenging – but it’s the glue that brings everything together.

When you establish a highly integrated pharmacy revenue cycle team, you’re bringing all stakeholders to the table and assuring that highly specialized work is performed by the right team members. These teams need to be integrated across pharmacy, revenue cycle and managed care contracting due to the increasing complexity and ever-changing regulations surrounding the reimbursement of high-cost medications.

However, this task is easier said than done, and it’s typical to see a lot of finger-pointing as you begin the integration process. But the pain is worth the gain. Because a pharmacy revenue cycle team that’s truly integrated has accountability to fix processes regardless of where they reside in the organization or who is involved with them.

Elements of an integrated pharmacy revenue cycle team

The holy grail of an integrated pharmacy revenue cycle team is its ability to drive cross-functional strategic alignment. When you have got the right pharmacy experts at the table helping to drive your organization’s strategy and key decisions, significant improvements in net revenue are quickly achieved.

Source: HFMA Modern Healthcare

5. Three Key Collaboration Opportunities for Health Systems and Drug Manufacturers in 2024

Dikesh Patel and David Hager

Collaboration between pharmaceutical manufacturers and health systems will strengthen in 2024. What’s driving this increased cooperation? There is a continued push by payers for value-based healthcare and the ongoing development of new niche medications administered to patients primarily in health system settings. Areas of further collaboration will include:

- Research and development (R&D) via joint sponsorship of clinical trials

- Data mining from a population health perspective to identify patients

- Developing partnerships to harness the power of AI and big data

- Advancing technological partnerships via digital therapeutics to obtain real-world evidence (RWE).

These collaborations will produce vital real-world data for pharmaceutical companies while accelerating health system innovation. Let’s take a closer look at three critical areas of collaboration for 2024:

-

Pre-approval Information Exchange Discussions

We expect to see more health system collaboration with pharmaceutical companies via joint sponsorship of clinical trials and participation in Pre-approval Information Exchange (PIE) discussions. The PIE Act of 2022 allows for communication between pharmaceutical companies (manufacturers) and healthcare decision-makers before approval to receive input from payers regarding clinical data.

PIE can be valuable in shaping final launch strategies and post-approval evidence plans. This engagement will enable health systems to be well-informed of emerging treatments, collaborate on novel research, and improve patient care by getting the right patients on the right therapies more rapidly. Simultaneously, pharmaceutical companies will refine their drug development strategies with a more nuanced understanding of health system dynamics.

-

Collaborative Population Health Management

A second area is collaborative population health management to identify patients for whom preventative or curative therapies can reduce the total cost of care. Recently, a successful partnership between Novartis and the National Health Service (NHS) in England has exemplified the positive outcomes achievable through pharmaceutical and health system collaborations.

The partnership improved treatment outcomes for cardiovascular diseases and reduced costs, garnering interest on a global scale. Similarly, we expect partnerships through health system pharmacy departments, population health departments and manufacturers to increase.

-

Digital and Technical Solutions

The third area of collaboration will be in digital and technological solutions. The remote patient monitoring (RPM) devices market is expected to reach $760 million by 2030 due to the push for decentralized healthcare, according to the GlobalData report. The report emphasizes the potential for RPM devices in at-home care, facilitated by advancements in 5G technology that enable faster real-time data analysis and sharing with providers.

These digital therapeutics will provide insight into daily medication use, an area where a collaborative approach between manufacturers, software companies, and health systems can address care gaps. This year, working together to create and deploy apps tailored to diverse medical conditions will be a paradigm shift in healthcare delivery.

An innovative national health system leader demonstrated early results in this area by partnering with major pharmaceutical companies to develop consumer-facing digital solutions. Collaborations with AstraZeneca for asthma management, Boehringer Ingelheim for type 2 diabetes management, and Merck for care coordination and medication adherence provide a proof of concept for the transformative potential of breaking down traditional barriers between manufacturers and health systems.

The evolving landscape of pharmaceutical and health system collaborations, exemplified by joint sponsorship of clinical trials, pre-approval information exchange, and new partnerships, will drive value-based healthcare transformation.

6. Private Equity Activity in Healthcare is Soaring – What Does it Mean for Health Systems?

Lynn Thoma and Jerame Hill

Private equity firms are well-known for investing in privately owned and publicly traded companies, typically sourcing funds from high-net-worth individuals, pension funds and other institutional investors. Their approach often involves strategic tactics such as leveraged buyouts, which aim to acquire and consolidate companies, streamline operations, and boost overall efficiency and financial performance.

In the pharmacy sector, private equity firms have increasingly taken an active role because of the industry’s potential for growth due to factors like an aging population, technological advancements, and escalating healthcare demands. Notably, recent data reveals a substantial surge in private equity activity in healthcare, with a 250% increase from 2010 to 2020, marking a jump from 352 deals in 2010 to 937 deals in 2020. This surge amounts to an estimated $749.5 billion in deal values between 2010 and 2020, which aligns with the pharmacy industry’s steady annual growth rate. Additionally, this trend signifies a shift in how healthcare services are managed and operated, with private equity firms playing a more active role in shaping the industry landscape.

Keeping up with a fast-changing market

Recognized for their intelligent decision-making and quick execution, private equity firms stand out against the slower nature of health systems. Agility allows private equity firms to capitalize on opportunities, make fast decisions, and act efficiently. Compared with their complex structures and regulations, health systems sometimes struggle to keep up with market changes effectively. Private equity will push health systems to streamline processes, be more flexible and adapt quickly. Recognizing private equity’s strategic moves in healthcare, health systems may benefit from keeping a pulse on pharmacy investments to help guide strategically how the market is shifting. Investing internally in your health system pharmacy capabilities will be important to capitalize on the opportunities.

Several noteworthy instances highlight the significant involvement of private equity firms in the pharmacy sector. We have observed private equity investments (majority, minority, and joint ventures) in hospitals/health systems on a macro level, infusion services, specialty pharmacy programs, and 503 A&B compounding operations. The pharmacy sector represents an attractive target market for private equity as it is highly regulated and a definite growth market.

Potential for future challenges

While private equity firm investments in the healthcare sector can bring about positive changes, there are concerns about potential negative implications for health systems in the future. One significant worry is the intensification of competition as private equity-backed entities enter the market, leading to new competitors or the rapid expansion of existing ones.

This heightened competition could result in market consolidation, potentially leading to patient and business leakage from health systems, reduced patient options and increased pricing pressure. With substantial financial resources and the ability to move quickly, private equity-backed businesses may also be able to negotiate more favorable pricing with suppliers and payers, putting smaller healthcare providers at a disadvantage.

It will be important to critically assess private equity involvement in pharmacy, as we expect investment interest in pharmacy programs to increase in 2024. With concerns around interest rates and the economy abating, private equity is currently estimated to have over $3 trillion in funds ready to invest. Used correctly, private equity investment can be a positive tool to build and advance services rapidly.

7. Health Systems Face Continuing 340B Program Challenges in 2024

Kristin Fox-Smith and Angela De Ianni

Health systems should prepare for a high degree of volatility and change associated with the 340B program for 2024. With continuing manufacturer pressure to restrict contract pharmacy programs, escalating data requirements, enhanced audit oversight, multiple 340B-related litigations, and increasing congressional investigations, pressure on the program will continue to mount.

New restrictions, 340B ESP, increase complexity

In 2023 alone, 10 pharmaceutical manufacturers implemented new restriction policies, with 10 manufacturers enhancing the previously placed restrictions. These restrictions are causing significant financial challenges for Covered Entities (CEs) with contract pharmacy relationships.

The varied requirements and processes for reinstating 340B pricing have become more complex and challenging for CEs to navigate. Most enhanced restrictions have implemented a location rule, where any designated pharmacy must be within 40 miles. Or will only allow a designation if the entity does not have an in-house pharmacy. Previously allowed exemptions for wholly owned pharmacies have also been removed or restricted by several manufacturers. This situation greatly strains CEs’ already limited resources with less revenue.

The ESP platform was intended to provide a secure way for CEs and manufacturers to work together to resolve duplicate discounts and restore contract pharmacy pricing. However, the ESP process has become more challenging to manage. With each change in a manufacturer’s restriction, the submission balance is reset for each entity, meaning any accumulations in place are removed, and the entity must restart the accrual process to retain 340B pricing. This has resulted in manufacturers requesting the submission of more claims while invalidating previously submitted claims. When the entity cannot produce more claims, the manufacturer removes the 340B pricing. As a result, submitting claims and monitoring pricing restoration is an administrative burden, and many CEs struggle to keep up with the volume of associated work.

Patient eligibility still a gray area

One result of ongoing litigation about patient eligibility is that some CEs have broadened their interpretations of the patient definition. Interpretations vary in scope and are accompanied by a degree of risk. Visante recommends that in the absence of a court decision, CEs considering patient definition expansion involve their 340B Oversight Committees – particularly Legal and Compliance teams – when evaluating the organization’s alternatives and risk tolerance.

Pandemic-initiated waiver removed

HRSA recently announced a rollback of the 2020 pandemic-initiated waiver for off-site, outpatient hospital facilities to be listed as reimbursable on the hospital’s Medicare Cost Report before participating in the 340B program. Implemented to recognize the need for hospitals to quickly respond to the rapidly evolving conditions of the COVID-19 pandemic, HRSA indicated that “pandemic conditions are no longer rapidly evolving in a manner that requires significant unplanned activities or changes by hospital-covered entities to accommodate these exigencies.” The final format and implementation of the waiver removal should be carefully considered for 2024 340B program operations.

How to protect and optimize your 340B program

The changing 340B landscape makes 340B program optimization more important than ever for health systems. Visante helps clients find and resource opportunities for improvement, which drives value back into the health system, enabling the organization to continue caring for vulnerable patient populations.

Below are some common strategies to use when looking to optimize your 340B program:

- Drive prescriptions to in-house or wholly-owned pharmacies.

- Revisit 340B policies and procedures to identify opportunities.

- Explore innovative clinic strategies to enhance patient eligibility.

- Manage and maintain 340B software systems to maximize 340B capture.

- Resource and implement referral processes to capture eligible prescriptions.

- Partner with providers to implement Medication Management Programs.

The 340B program remains critical for hospitals’ ability to offer continued support for the care of vulnerable patient populations. With multiple efforts underway to curtail the 340B program, there will again be a high degree of volatility associated with the program in 2024. CEs should prepare for enhanced scrutiny and escalating documentation and oversight requirements. In addition to 340B program optimization, we recommend that hospitals proactively evaluate other opportunities to replace potential 340B program financial reductions. This could include pharmacy revenue cycle management, expanded internal specialty pharmacy services, and building or expanding internal infusion services.

8. GRIT – A Required Attribute for Successful Pharmacy Leaders in 2024

Steve Rough and Phil Brummond

“Nothing in this world can take the place of persistence. Talent will not; nothing is more common than unsuccessful people with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan PRESS ON has solved and always will solve the problems of the human race.” – Calvin Coolidge

Pharmacy is proving to be a game changer for health systems looking for real solutions that can deliver immediate value and contribute to an organization’s long-range strategy. More health system executives recognize the opportunities in pharmacy for improved clinical, operational, and financial performance and are looking to their pharmacy executives to deliver strategies that drive organizational results. This means pharmacy leaders MUST come to the table with growth-minded, business-focused and patient-centric solutions that will help positively transform the organization.

The pharmacy executive who delivers exceptional patient care and bottom-line value to the organization facilitates a culture that fosters the growth of others and team success and demonstrates GRIT will excel in 2024.

Below is what we believe GRIT looks like for the aspiring, successful pharmacy leader. It’s not about how hard you can work but how much you can take and keep moving forward.

GROUNDED in sound business strategy. Leading a health system pharmacy means running a medium-sized U.S. corporation, given the potential for revenue, operational efficiency, and customer deliverables. Pharmacy leaders must also be business strategists and understand how to deliver value to all stakeholders effectively and efficiently.

Optimizing REVENUE GROWTH opportunities such as specialty pharmacy and coordinated infusion services offer incredible value to the health system organization and serve patients in extraordinary ways. Also, understanding and managing the pharmacy revenue cycle has become essential to successful health system pharmacy organizations.

INVESTING strategically in people, technology, and new service offerings is critical to the success of contemporary pharmacy leaders. Overcoming workforce challenges demands new approaches to recruiting and retaining top talent, understanding and designing unique service offerings, and providing expansion into new markets and more comprehensive patient care. And technology is needed wherever medications are used. It’s no longer enough to purchase and implement technology; the successful organization must optimize technology to its most significant potential.

TENACITY that gets results for patients, the organization, and the community you serve. The most successful pharmacy leaders are those whose passion for patient care excellence drives their behavior and ensures that the health system delivers extraordinary care and fuels growth for future generations.

EXCELLING AT THINGS THAT TAKE ZERO DOLLARS AND ZERO TALENT will differentiate the most successful leaders from the rest. This includes displaying perpetual optimism and believing in others in the face of challenge, establishing a clear vision, focus and clarity of purpose for the team, being willing to have difficult conversations at the right time, gracefully managing through conflict, incessantly displaying gratitude and enthusiasm, having a willingness to take risks when it’s the right thing to do, being comfortable with ambiguity, and insisting upon accountability and preparation from one’s self and from others.

At Visante, we see how health system pharmacy leaders embrace and excel at the opportunities presented to them and their teams. It’s an incredible time to be in health system pharmacy at any level, and leaders are demonstrating to the C-suite and boards of directors that pharmacy can positively transform the health system organization. We applaud the leaders at all health systems for their commitment to excellence!

9. Four Key Strategies to Improve Efficiency in Health System Pharmacy

Joe Lassiter, Jim Lund and Shannel Gaillard

A transformative shift is underway in health system pharmacy due to growing financial challenges and pervasive staffing shortages. Health system pharmacies are looking for proactive ways to be more operationally efficient and nimble and to create stronger financial performance for the organization.

Repeatedly, high-performing pharmacy organizations achieve more robust efficiency in three ways: standardizing services, consolidating services, and implementing and optimizing technology. Innovative pharmacy leaders consistently embrace these fundamental operational practices to stay at the forefront of operational efficiency. Forward-thinking organizations also employ a fourth key strategy: optimizing internal benchmarking performance. This strategy can provide valuable insights to enhance operations and achieve greater efficiency.

A four-prong approach to achieve improved efficiency

Persistent financial stressors place a relentless strain on available resources, be it capital or labor. As resource stewards, pharmacy leaders must ensure optimal utilization to demonstrate maximum value. Financial challenges and workforce pressures are here to stay, so it’s imperative to adopt performance-based approaches that improve efficiency, bolster the bottom line and support the workforce.

These four excellent strategies are crucial for pharmacy organizations seeking heightened efficiency.

- Standardizing services streamlines operations, reducing unnecessary variations and enhancing the predictability and quality of care. This move minimizes waste and allows for a more efficient allocation of labor resources.

- Centralizing services presents an opportunity to consolidate services, minimizing redundant efforts across multiple sites. This strategy curtails waste and reduces resource requirements, optimizing available capital and labor and decanting valuable space in the hospital.

- Embracing and optimizing new technology can revolutionize operational effectiveness. From advanced medication preparation and dispensing systems to innovative inventory management tools, technology can significantly enhance efficiency, augmenting the capacity of our workforce while simultaneously reducing costs.

- Benchmarking using internally validated metrics can significantly improve operational efficiency and enhance transparency. A proactive benchmarking approach includes an analytics program to track key operating metrics – established in a standardized, consistent manner with relevant stakeholders. Creating a framework to develop targets while regularly reviewing metrics is also essential. Utilizing internal benchmarking data to drive efficiency over time against oneself allows organizations to change the processes and behaviors necessary to improve overall performance.

Centralized Services Centers improve operational efficiency

Implementing Centralized Service Centers (CSCs) is a crucial part of our recommended approach to achieve high performance while driving efficiency. CSCs provide a platform to centralize and standardize services, effectively driving down labor costs and minimizing waste across decentralized sites within the healthcare system. Service consolidation optimizes resource utilization and allows a more concerted focus on quality and consistency in care delivery.

The CSC facility also provides the organization with adequate space to grow entrepreneurial strategic pharmacy services that drive new revenue into the system (e.g., specialty and mail order pharmacies, ambulatory infusion programs) and to optimize supply chain operations at a lower cost than within traditional healthcare spaces. The centralization of production activities creates an environment where sophisticated technologies and automation systems can be implemented to improve operational efficiency, quality, and financial performance. A robust data analytics program provides actionable information to identify opportunities for CSC growth and enhanced system efficiency. Ongoing benchmarking continues to measure the facility’s success while providing stakeholders with valuable information to drive further operational and financial improvements.

In conclusion, the imperative for enhanced operational efficiency in the healthcare system cannot be overstated. By adhering to principles of standardization, centralization, and technological advancement, organizations not only fortify their financial standing but also ensure the sustainability and effectiveness of our workforce. Developing a strong internal pharmacy analytics and benchmarking program further strengthens the organization. Through these concerted efforts, we pave the way for a healthcare system that is not only financially resilient but also supports its workforce and excels in delivering quality care.

10. Prescription Drug Prices Again a Challenge in 2024

Jim Jorgenson, Wendy Weingart & Kasandra Botkin

Prices for prescription drugs are again a pain point for 2024 and remain a challenge for pharmacy and hospital/health systems in general. Drugs continue to be a significant component of overall healthcare spending. In 2021, retail prescription drugs accounted for more than 16% of fully insured private health plan premiums after rebates and that number continues to rise.

Median prices of new and existing drugs are also expected to rise. The U.S. Food and Drug Administration’s Center for Drug Evaluation and Research noted the median annual price for approved new drugs increased from $180,000 in 2021 to $222,000 in 2022. Pharmacy trends are not expected to slow down in 2024, especially considering the combined impact of newly approved cell and gene therapies and more expensive specialty drugs (9% of drugs approved in 2008-2013 cost $150,000 or more annually, compared to 47% of those approved in 2020-21).PricewaterhouseCoopers predicts that the inflationary impact of pharmaceutical pricing will be in the high single or double digits from 2023-2024.

Inflation Reduction Act: Prescription Drug Provisions

The Inflation Reduction Act (IRA) granted the Centers for Medicare and Medicaid Services (CMS) the ability to negotiate prices for the first time. However, the impact of price negotiations on the first 10 drugs will not begin until 2026, providing no relief in 2024. Given the contentious split between political parties regarding the IRA, it is doubtful that any additional congressional action directed toward drug manufacturers will come in 2024. However, the IRA incidentally impacted the insulin cost in 2023, when the three largest insulin manufacturers voluntarily reduced the price of insulin products. We will continue to see this trend into 2024 and can adjust budgets based on this new lower price.

Biosimilar Specialty Drugs

Last year in our Top 10 specialty pharmacy projections, we highlighted the potential impact of biosimilar specialty drugs, particularly adalimumab. That was certainly on point and will continue in 2024 to be a potential “cost deflator”, as the prices of biosimilars can be 50% lower than their reference products. Using the adalimumab example, Amgen launched its adalimumab biosimilar, Amgevita™, in January 2023. To date, the FDA has approved nine adalimumab biosimilars. Even though not all biosimilars are interchangeable, the overall adoption of biosimilars to specialty drugs has substantial potential to help reduce drug costs in 2024.

Pharmacy Benefit Managers (PBMs)

PBMs and their impact on drug prices will continue to be in the spotlight for 2024, and there is some hope of congressional action. The prime criticisms of PBMs are a lack of transparency, a rebate extraction system that causes price increases, various opaque fees, and increasing vertical integration with insurers and pharmacies. As a result, PBMs can tip the pharmaceutical market in their favor while extracting more significant profits.

A report by Nephron Research highlighted these issues, noting that fees paid to PBMs have more than doubled in the last five years. Despite various bipartisan and internal struggles that have derailed congressional involvement on this issue, several bills addressing PBMs are under consideration. Congress is working to advance a package called the Lower Costs, More Transparency Act that includes PBM provisions. The bill focuses on more than just pharmacy benefits; it contains measures requiring PBMs to provide employers with extensive data, ban spread pricing in Medicaid, and boost fee disclosures and PBM compensation.

Drug Shortages

Drug shortages will continue to be a hidden driver of elevated drug costs in 2024, often forcing the use of more expensive alternatives. As we saw with the tornado that hit the Pfizer plant in North Carolina in 2023, natural disasters continue to play a role in exacerbating the drug shortage problem. Pfizer announced that the penicillin shortage will last into 2024, and others have reported that the GLP-1 Ra diabetes medication shortage is not expected to be resolved until mid-2024. The ADHD medication shortage is also likely to continue into next year.

Drug shortages will continue to contribute to increased drug costs in 2024. However, some relief may be in sight, as the FDA is working with several 503B Voluntary Outsourcing organizations to fast-track production of some critical injectable medications. However, many 503B companies struggle to meet accreditation standards and good manufacturing practice (cGMP) requirements, making it hard for health systems to rely on them entirely.

Healthcare Disruptors

Disruptors are also taking a larger position in the hospital and health system market. As we mentioned last year, Civica Rx and Mark Cuban Cost Plus Drugs (MCCPD) continue to expand their portfolios and increase their market. However, new to the market in 2023 was RxPass from Amazon Pharmacy. RxPass allows Amazon Prime members to pay $5 monthly to obtain as many generic drugs as needed from their list of 50 medications. RxPass will be in direct competition with MCCPD. But RxPass is already integrated into thousands of more pharmacies than MCCPD and offers rates at a steeper discount. Although these companies largely target generic medications, their impact on the drug market will continue to be felt in the coming year.

5 Actions to Consider to Help Control Costs in 2024

For 2024, pharmacy engagement to address drug costs will be critical. Here are five actions you can take to help control costs:

- Support formulary management to provide a portfolio of drugs representing the best therapies and pharmacoeconomics for hospitals and health systems.

- Work with prescribers to select and utilize high-cost drugs in an optimal manner and in the appropriate setting.

- Work with hospital human resources/benefits to create an optimal PBM approach for employees and at-risk populations managed by the organization.

- Work with prescribers to proactively address the best alternatives in drug shortage situations.

- Support care transitions to the outpatient setting. It will be critical for pharmacists to ensure complete and accurate medication reconciliation and efficient pharmacy operations with minimal waste.